Table of Contents

- Bonds - CathalAghamjot

- How the Bond Market Works - YouTube

- Bond Market vs Stock Market – The Tao Of Trading Blog

- What Investors Should Know About Bonds | Investing | US News

- What’s the Deal with Surging Bond Yields? | J.P. Morgan

- Bond Market - Meaning, Examples, Types, Pros and Cons

- Bond-Market - a summary of bond market and the things you need to know ...

- Just 3 Things | Zero Hedge

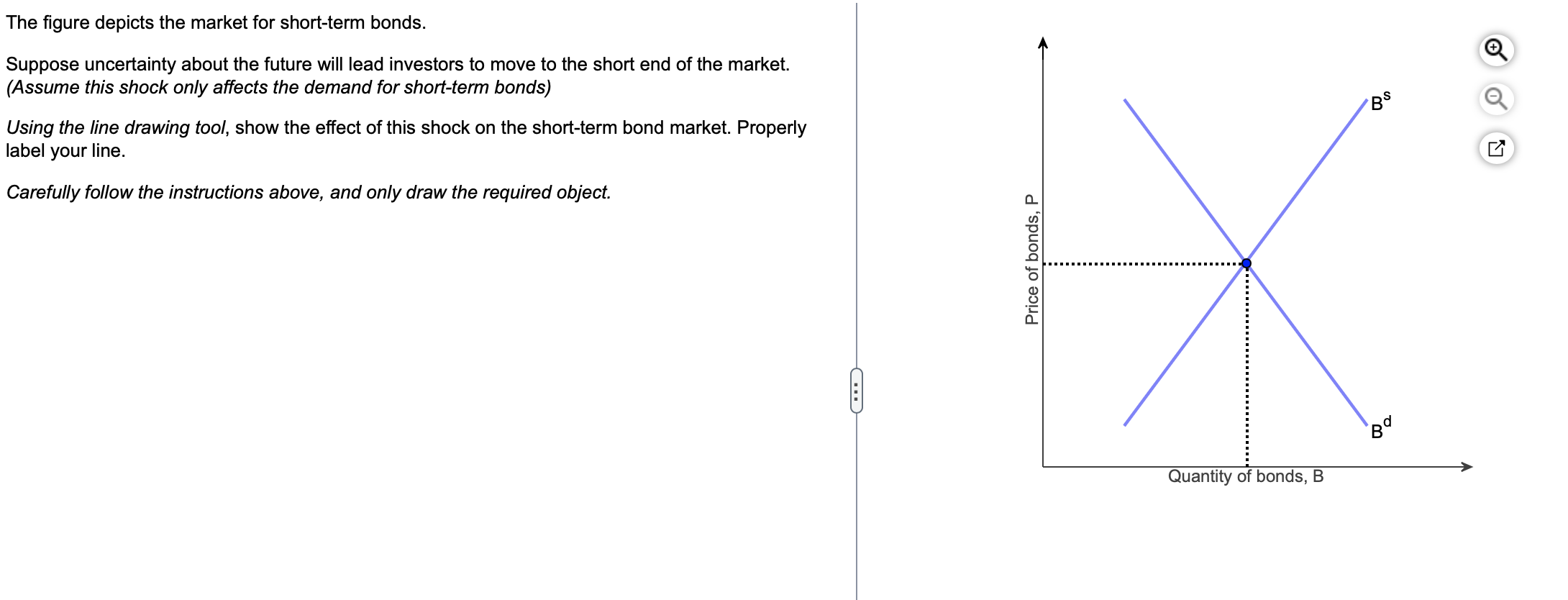

- Solved The figure depicts the market for short-term bonds. | Chegg.com

- How is it to have Indian Bond Market in Global Indices?

What are Government and Treasury Bonds?

Characteristics of Government and Treasury Bonds

Benefits of Investing in Government and Treasury Bonds

Investing in government and treasury bonds offers several benefits, including: Diversification: Adding government and treasury bonds to a portfolio can help diversify investments and reduce risk. Stable Returns: These bonds offer a fixed rate of return, which can provide a stable source of income. Low Volatility: Government and treasury bonds are less volatile than other investments, such as stocks, making them a good option for risk-averse investors.

Trading Government and Treasury Bonds on TradingView

TradingView is a popular platform for traders and investors to buy and sell financial instruments, including government and treasury bonds. The platform offers a range of tools and features, including: Real-Time Data: TradingView provides real-time data on government and treasury bond prices, allowing investors to make informed decisions. Charts and Analysis: The platform offers a range of charts and analysis tools, enabling investors to analyze market trends and identify potential trading opportunities. Community Forum: TradingView has a large community of traders and investors, providing a platform for discussion and idea sharing. In conclusion, government and treasury bonds are a low-risk investment option that offers a fixed rate of return and liquidity. TradingView is a popular platform for buying and selling these bonds, providing real-time data, charts, and analysis tools. Whether you are a seasoned investor or just starting out, government and treasury bonds can be a valuable addition to your portfolio. By understanding the characteristics, benefits, and trading options available, you can unlock the potential of the bond market and achieve your investment goals.For more information on government and treasury bonds, and to start trading on TradingView, visit their website today.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.